Foreign Bank Account Reporting

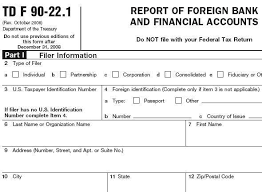

In today’s worldwide economy, it is commonplace for U.S. taxpayers to have financial accounts (banking, pension, investment, etc.) located outside of the United States. They may be surprised to know that just by keeping money in a foreign account you might have to file a special form with FinCEN, the U.S. Treasury Department’s Financial Crimes and Enforcement Network. Not filing the form can lead to heavy penalties. The special form is commonly called the “FBAR” or FinCEN Form 114, Report of Foreign Bank and Financial Accounts.

In today’s worldwide economy, it is commonplace for U.S. taxpayers to have financial accounts (banking, pension, investment, etc.) located outside of the United States. They may be surprised to know that just by keeping money in a foreign account you might have to file a special form with FinCEN, the U.S. Treasury Department’s Financial Crimes and Enforcement Network. Not filing the form can lead to heavy penalties. The special form is commonly called the “FBAR” or FinCEN Form 114, Report of Foreign Bank and Financial Accounts.

FBAR in a Snapshot

- US citizens with foreign accounts totaling $10,000 at any time during the year must file.

- The FBAR must be filed electronically through the FinCEN’s BSA E-Filing System.

- The due date for filing is now April 15 with an extension available until October 15.

- Not correctly reporting foreign accounts can result in a penalty of up to $10,000 per violation.

Who Must File A FBAR?

Every US citizen, green card holder, resident alien, partnership, corporation, estate, or trust must file the FBAR if they have financial interest in or signature authority, or other authority over any financial accounts. If the aggregate value of these financial accounts exceeds $10,000 at any time during the calendar year. These accounts include bank, securities, or other types of financial accounts in a foreign country.

What Types of Foreign Financial Accounts are Reportable?

The following types of accounts have to be reported on the FBAR if they meet the filing requirement of $10,000:

- Bank Accounts (checking and savings).

- Investment Accounts.

- Mutual Accounts.

- Retirement and Pension Accounts

- Securities and other Brokerage Accounts.

- Debit and Credit Cards.

- Life Insurance and Annuities Having Cash Value.

Why File an FBAR?

Under the present FBAR rules, if you are required to file but either you do not file on time or do not accurately report your foreign accounts you may be subject to a penalty of up to $10,000 per violation. Even if you are unaware it was required. If you are cognizant of your requirement and do not file an accurate FBAR or if you fail to file it on time, you could get hit with a $100,000 penalty per violation or an even higher penalty, depending on your account balances at the time of the violation.

When to File an FBAR

The FBAR, FinCEN Form 114, report of foreign bank accounts,due date April 15 of each year to report foreign bank accounts owned in the previous calendar year. Any taxpayer required to file an FBAR who misses the April 15 FBAR due date will be granted an automatic extension of six more months to file. The extended deadline date is now October 15.

The extension will always be automatic. No extension longer than six months is normally granted.

An FBAR is not filed with a federal tax return. It is filed separately and directly with FinCEN. Significantly, if you are required to file an FBAR, you must file the form even if you are not required to file a U.S. return with the IRS.

What if the filing deadline is missed? The IRS is now conducting an offshore voluntary disclosure initiative (Streamlined Procedures) for people who need to file late foreign bank account reports and report previously undeclared foreign income.

How an FBAR Can Be Related to a Tax Return

Although the foreign bank account report is not a tax form and is not submitted to the IRS, information relating to foreign bank accounts may need to be coordinated with information on a tax return.

Income generated inside of these foreign financial accounts is reported on an income tax return in the year the income is earned. You will report the foreign income based on the type of income generated. For example, interest and dividends are reported on Schedule B, capital gains on Schedule D, etc.. If you earn dividends or interest in these accounts, be sure to check the box in Part III Line 7a of Schedule B and indicate the country or countries where you have accounts.

In some cases, a person may need to file Form 8938, Statement of Foreign Financial Assets, with their tax return. This tax form is separate from the foreign bank account report even though it has similar information. There are separate thresholds for being required to disclose foreign accounts. For Form 8938, the threshold starts at total foreign account balances of $50,000 on the last day of the year or $75,000 at any time during the year. There are higher reporting thresholds for married couples filing jointly and for Americans living abroad. The following chart from the IRS may be helpful: Comparison of Form 8938 and FBAR Requirements. Also, any foreign taxes paid on foreign income may qualify for the Foreign Tax Credit on Form 1116.

Exceptions to Filing an FBAR

Accounts held at US military banks even if those banks are located in foreign countries do not have to be reported. Military banks are considered domestic U.S. banks. Accounts held at banks found in Guam, Puerto Rico, and the US Virgin Islands do not have to reported, as these are U.S. territories. U.S. based accounts held by a branch or division of a foreign bank do not have to be reported.