Businesses have been using deep learning, neural networks, and other forms of artificial intelligence (AI) for several years to track and predict consumer behavior—so-called “big data.” The government also uses AI to identify trends in data and draw inferences from that data. For instance, Terrorist A and Terrorist B both have a close connection to Person C. Artificial intelligence techniques help the FBI or other government agency see that connection and predict whether Person C is a likely terrorist.

A relatively new use of these techniques is in the field of tax collection. The IRS has a $99 million contract with the private company Palantir to use its Gotham platform to help identify tax evaders.

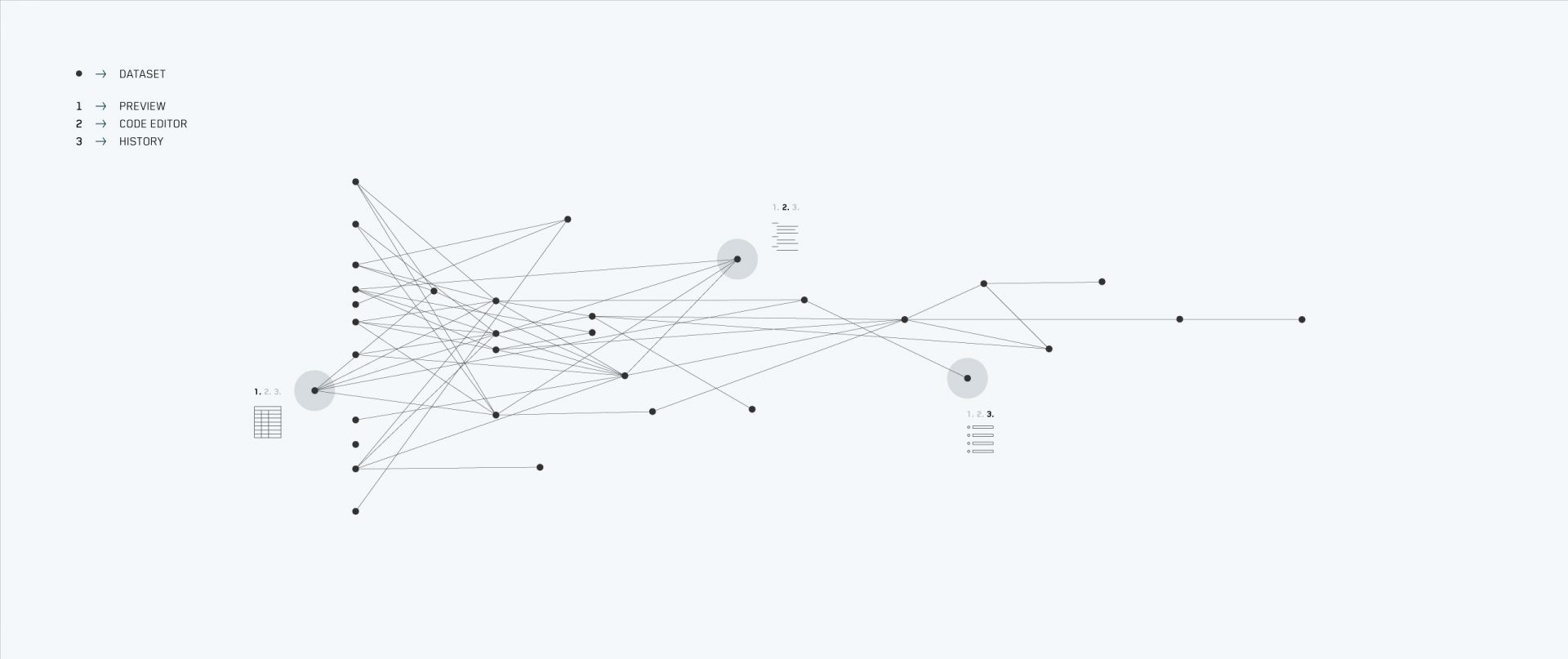

How does the system work? Palantir says that the Gotham system takes data from many sources—presumably both from within the IRS and from outside it. It then maps that data to identify relationships. The source data flows into Gotham on an ongoing basis so that virtual alarm bells go off when a trigger is reached. According to Palantir, “In Gotham’s integrated Applications and Modules, users can search all data sources at once, explore divergent hypotheses, surface unknown connections and patterns, and share insights with their colleagues.”

Experts have speculated that the Gotham system uses vast amounts of data from many sources: IRS tax data, bank and credit card records, passport applications and air travel tracking, even social media posts. To speculate, let’s suppose that you file a tax return claiming that your total income was minimal. Yet, you recently posted on Facebook about your new luxury car, and your passport has a stamp from your recent ski trip to Switzerland. Hmm, it doesn’t take an AI genius to suspect that something may be amiss. Using Gotham, the IRS can now track that data and draw those inferences in real time.

The IRS has always had simple tools to identify when a taxpayer claims deductions that seem out of whack. If you make $100,000, but claim $30,000 in charitable deductions, you are either very charitable or very suspicious. What is new with Palantir is the ability to probe deeper and see connections that might not be obvious.

IRS Commissioner Charles Rettig is a fan. “How do you think we found these people [tax cheats]?” he said recently at a conference on artificial intelligence. “If I get a first name and a cellphone number, you’d be shocked how much information Palantir can provide.”

Yet, there are also risks of a Big Brother effect. According to a recent article in the Wall Street Journal, “Real risks exist if algorithms for audit selection inadvertently discriminate against taxpayers by race or location. And relying on technology can make an already impersonal agency even more so, perhaps confusing taxpayers who may struggle to understand why the government is coming after them and want to deal directly with people at the IRS.”